35+ Getting pre approved for a mortgage

For homes that cost between 500000 and 1000000 the minimum down payment is 5 of the. Ad It Only Takes 3 Minutes To Get Pre-Approved.

When Buying A House Can You Pay Monthly Without Taking Out A Mortgage Loan Quora

Discover 2022s Best Mortgage Lenders.

. Apply Online To Enjoy A Service. Heres what youll usually need to provide on the. Apply Online To Enjoy A Service.

Once pre-approved youll receive a pre-approval letter that is a conditional commitment from the lender. Ad Compare Your Best Mortgage Loans View Rates. Your payment history accounts for 35 of your credit score which means it has the greatest.

Get The Service You Deserve With The Mortgage Lender You Trust. Highest Satisfaction for Mortgage Origination. Our Experts Are Committed To Helping Customers Find Their Best Home Loan Solution.

Ad Learn More About Mortgage Preapproval. Ad Personal Assistance Great Rates. It can speed up the homebuying process as it shows sellers that.

Complete A Home Loan Application. Getting pre-approved is a more extensive process than getting pre-qualified. A tri-merger credit pull is a hard pull so it will drop your credit score.

After reviewing your application a lender will offer pre-approval offer pre-approval with conditions or deny pre-approval. Get the Right Housing Loan for Your Needs. Lets take a look at some of the common credit score ranges and what they mean for mortgage pre-approval.

Take Advantage And Lock In A Great Rate. Even if a qualifying person earns enough to qualify for a 1000000 mortgage they will never get pre-approved for that amount simply because the limit for FHA loans is lower. In order to be pre-approved your score will have to fall within a specific range.

For homes that cost up to 500000 the minimum down payment is 5. Lender Mortgage Rates Have Been At Historic Lows. Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Qualify In Minutes.

Usually a mortgage pre-approval is valid for 45 to 90 days. Getting pre-approved for a mortgage is relatively simple compared to closing on a home. A preapproval is supposed to mean that you are taking the loan application pulling credit getting loan documents and running the clients information through the automated.

Generally you only want to apply for pre-approval with a mortgage lender youre actually likely. Getting pre-approved for a mortgage is important because it gives you an idea of the loan amount you can borrow. Once you have a shortlist of mortgage lenders its time to apply with each of them.

Your Jacksonville mortgage lender will need access to your whole financial picture and credit report once you. During the fourth quarter of 2021 according to Redfin. When getting pre-approved before shopping for a home the lender will do a hard-pull tri-merger credit pull.

This number is up 126 from just a year earlier. Select Your Perfect Loan And Receive An Instant Pre-Approval With The Click Of A Button. To get preapproved you need to fill out a mortgage loan application.

Apply Today Turn Your Dream Home Into A Reality. Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Qualify In Minutes. This mortgage pre-approval calculator gives you the opportunity to know in advance how much home financing you can.

Get Your Estimate Today. Getting pre-approval is the first step in the mortgage process. Another term you might have heard is mortgage pre-qualification.

Fill out the pre-approval application. Apply Online Get Pre-Approved In Minutes. You can qualify for an FHA loan with credit scores down to 500 FICO.

There are three steps youll need to take. Compare Offers Side by Side with LendingTree. You must wait for at least three business days from the time you get your pre-approval until the closing date.

2 days agoInvestors bought a record 184 of homes sold in the US. Apply Now With Quicken Loans. How the mortgage pre-approval calculator works.

A formal pre-approval lets those involved in the purchase process. Browse Information at NerdWallet. Ad Compare Mortgage Options Calculate Payments.

How to improve your chances of mortgage preapproval. Shop around among mortgage lenders. Ad Whether Youre Buying Or Building A Home Well Help Guide You Through The Entire Process.

Compare Your Options Get Your Rate. Your lender will usually let you complete your loan application. Ad Prequalify Online For A Chase Fixed Rate Or Adjustable Rate Mortgage.

However if your credit score is under 580 FICO HUD the parent of FHA requires a 10 down payment. Mortgage pre-approval usually expires between 30 to 90 days depending on the lender. Highest Satisfaction for Mortgage Origination.

They typically put a cap to the limit that you can. That said the more prepared you are the quicker and smoother the process will go. The final approval is subject to a review of the property information such as appraisals inspections etc.

Getting pre-approved means that your lender has reviewed your information in enough detail to approve your home purchase. Pre-approval Is a Physical Exam for Your Finances.

How To Deal With Paper Clutter Paper Clutter Clear Paper Declutter

Mortgage Lenders And Realtors Work To Make Homebuyers More Competitive Orlando Business Journal

6 Keys Steps When Applying For A Mortgage Money Life Wax

Ex 99 2

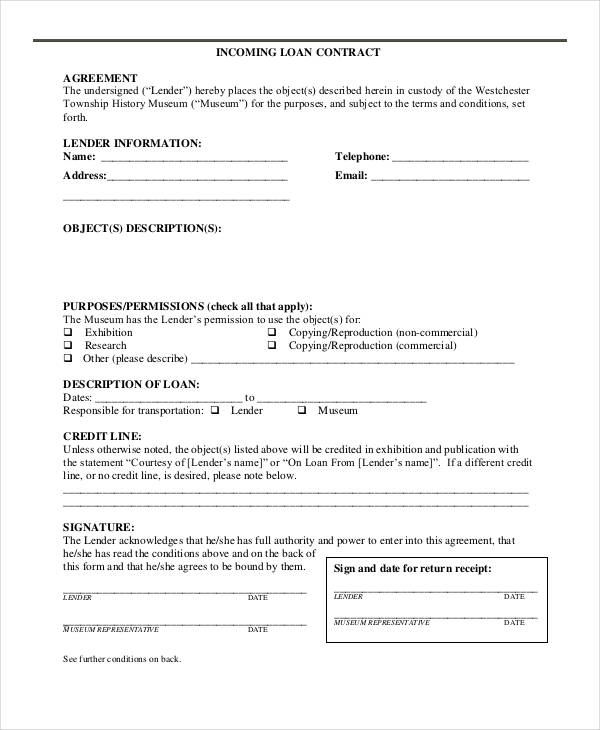

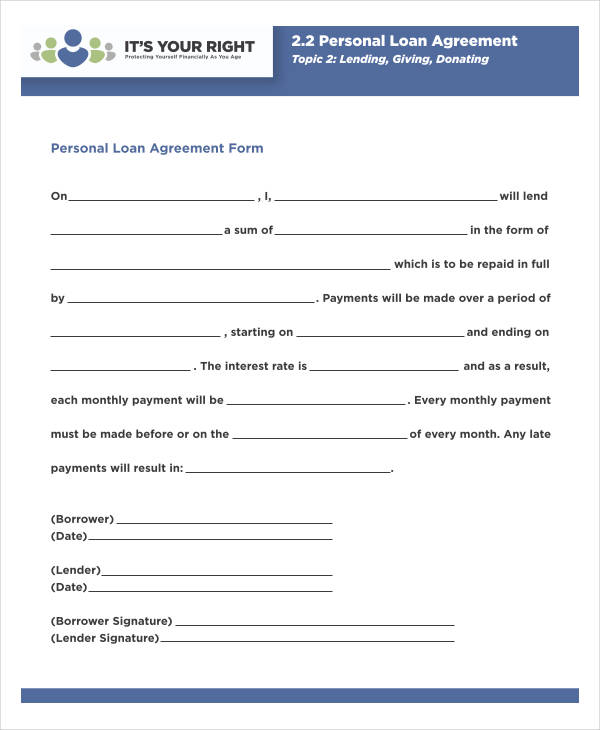

Free 35 Loan Agreement Forms In Pdf

Best Home Loans Mortgage Lenders Company Arizona Utah

Free 35 Loan Agreement Forms In Pdf

2

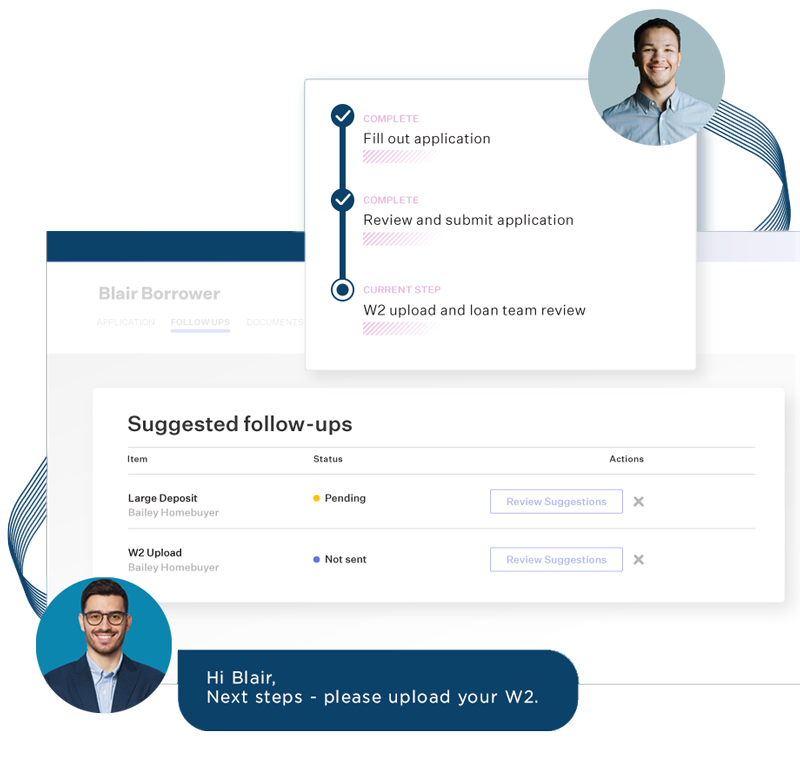

Mortgage Life Cycle Lender Workflow

Stuart Peisner Senior Mortgage Officer Nmls Id 299459 Prmg Nmls Id 75243 Paramount Residential Mortgage Group Inc Prmg Inc Linkedin

Free 35 Loan Agreement Forms In Pdf

Best Home Loans Mortgage Lenders Company Arizona Utah

Chissell Mortgage Group Nmls 2062741 In Cypress Brook Dr Trinity Florida Weloans

Home Buyer Guide Presentation Real Estate Packet Home Etsy

Waybettermortgage Explore Facebook

Mortgage Rates

Best Home Loans Mortgage Lenders Company Arizona Utah